Saving money from salary is a crucial step toward achieving financial stability and building a secure future. Whether you’re earning a modest income or a substantial paycheck, learning how to save money from salary every month can transform your financial landscape, helping you achieve goals like buying a home, funding education, or preparing for retirement. This comprehensive guide explores actionable strategies to help you save effectively, with practical tips to ensure your money works for you.

Why Saving Money from Salary Matters

Saving a portion of your salary each month is more than just a good habit—it’s a financial safety net. Unexpected expenses like medical bills or car repairs can arise at any time, and having savings ensures you’re prepared. Moreover, consistent saving helps you achieve long-term goals, such as early retirement or financial independence. By prioritizing how to save money from salary, you gain peace of mind and the freedom to live life on your terms.

The Importance of a Budget

Creating a budget is the cornerstone of learning how to save money from salary every month. A budget acts like a roadmap, guiding your financial decisions and helping you allocate funds wisely. Start by listing your monthly income and expenses, categorizing them into fixed costs (rent, utilities, loan payments) and variable costs (groceries, entertainment). The 50/30/20 rule is a popular budgeting method: allocate 50% of your income to needs, 30% to wants, and 20% to savings and investments. This structured approach ensures you’re saving a significant portion of your salary while covering essential expenses.

Automate Your Savings ( Save Money from Salary )

One of the best ways to save money is to automate the process. Set up an automatic transfer from your checking account to a savings account each time you receive your salary. This “pay yourself first” strategy ensures you save before spending on non-essentials. Many banks offer automated savings plans, and some employers allow you to split your direct deposit, sending a portion of your paycheck directly to savings. Automating your savings reduces temptation and makes saving a consistent habit.

10 Ways to Save Money from Salary

Here are 10 practical ways to save money from your salary, designed to fit various lifestyles and income levels:

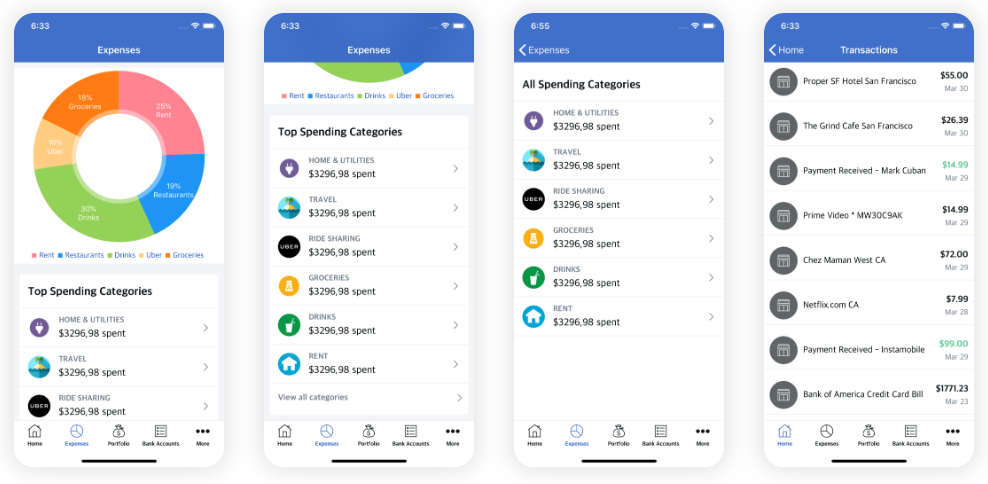

- Track Your Expenses: Monitor your spending to identify areas where you can cut back. Use apps like Mint or YNAB to categorize expenses and spot patterns. Knowing where your money goes is the first step to saving more.

- Cut Unnecessary Subscriptions: Review your subscriptions for streaming services, gym memberships, or magazines. Cancel those you rarely use to free up funds for savings.

- Cook at Home: Dining out frequently can drain your budget. Preparing meals at home is a cost-effective way to save money from salary every month. Batch cooking can also save time and reduce grocery costs.

- Shop Smart: Use cashback apps, coupons, and loyalty programs when shopping. Waiting 24 hours before making non-essential purchases can curb impulse buying, preserving your savings.

- Build an Emergency Fund: Set a goal to save $500–$1,000 for unexpected expenses. This fund acts as a buffer, preventing you from dipping into long-term savings.

- Pay Off High-Interest Debt: High-interest debt, like credit card balances, can eat into your ability to save. Prioritize paying off these debts to free up more of your salary for savings.

- Use a High-Yield Savings Account: Place your savings in a high-yield savings account to earn better interest rates. This ensures your money grows while remaining accessible.

- Limit Online Shopping: Online stores make spending easy. Set a monthly budget for discretionary purchases to avoid overspending and boost your savings.

- Carpool or Use Public Transport: Reducing transportation costs, such as fuel or parking, can add up significantly. Consider carpooling or using public transit to save money.

- Invest Wisely: Once you’ve built a solid savings foundation, consider low-risk investments like mutual funds or fixed deposits to grow your wealth over time.

The Best Way to Save Money: Pay Yourself First

The best way to save money from your salary is to treat savings as a non-negotiable expense. As soon as you receive your paycheck, allocate a fixed percentage—ideally 20% or more—to savings or investments before spending on anything else. This approach, often called “paying yourself first,” ensures you prioritize your financial future. For example, if your monthly salary is $3,000, aim to save at least $600 before covering other expenses. Over time, this habit builds a substantial financial cushion.

Leverage Digital Tools for Savings

In today’s digital age, numerous apps and tools can help you save money from salary. Budgeting apps like Mint track your spending, while platforms like Acorns round up purchases and invest the spare change. Additionally, cashback platforms like Rakuten offer rewards for online shopping, which can be redirected to your savings. These tools simplify the process of saving and make it easier to stay on track.

Common Questions About Saving Money

To address common queries, here are answers to two “People Also Ask” questions related to how to save money from salary:

How Much Should I Save from My Salary Each Month?

A good rule of thumb is to save 20% of your monthly income, as suggested by the 50/30/20 rule. However, this can vary based on your financial situation. If you’re paying off debt or have high living costs, start with a smaller percentage, like 5–10%, and gradually increase it. The key is to set a realistic goal and stick to it.

What Are the Best Investments for Salary Savers?

For beginners, low-risk options like high-yield savings accounts, fixed deposits, or mutual funds are ideal. These provide steady returns without significant risk. Consult a financial advisor to tailor investments to your goals and risk tolerance.

Avoiding Common Pitfalls

When learning how to save money from salary, avoid these common mistakes:

- Overspending on Wants: It’s easy to overspend on non-essentials like dining out or luxury items. Stick to your budget to ensure you have enough for savings.

- Neglecting an Emergency Fund: Without an emergency fund, unexpected expenses can derail your savings plan. Aim to save 3–6 months’ worth of expenses.

- Ignoring Debt: High-interest debt can hinder your ability to save. Prioritize paying it off to free up more of your salary.

FAQ: Saving Money from Your Salary

Q: How can I save money from a low salary?

A: Start by creating a strict budget and cutting non-essential expenses, like dining out or subscriptions. Even saving $5–$10 per week can add up over time. Use cashback apps and shop sales to maximize your budget.

Q: What’s the best way to save money automatically?

A: Set up automatic transfers to a savings account or investment plan right after receiving your salary. Many banks offer this feature, and it ensures you save consistently without manual effort.

Conclusion

Mastering how to save money from salary is a game-changer for achieving financial freedom. By creating a budget, automating savings, and following the 10 ways to save money outlined above, you can build a secure financial future. The best way to save money is to prioritize savings as a fixed expense and use tools like high-yield savings accounts or budgeting apps to stay on track. Start small, stay consistent, and watch your savings grow. Share your favorite money-saving tips in the comments below—we’d love to hear how you’re making your salary work for you!